Poultry Processing Machines – Asia Pacific Poultry Industry

The Asia Pacific region is the largest food service region in the world consisting of very diverse countries that vary highly in demographics, income level, market maturity and dietary habits. For e.g., the consumption habits of fish, meat, poultry and seafood differs greatly from market to market. In India, a lot of consumers are vegetarians while in Hong Kong (Greater China), Hong Kong residents consume the highest per-capita combined seafood and meat in the world. Add to this the fast changing consumer behaviour, any investor or food manufacturing and supplying company targeting the Asia Pacific markets need to adapt quickly.

Poultry Sector In ASEAN

The five key poultry markets of South East Asia are Malaysia, Indonesia, Thailand, Vietnam and the Philippines.

Malaysia Poultry Industry

Malaysia has a population of 30.5 million people and the Malaysian poultry industry has been going through great changes over the last 10 years. Production of chicken meat has increased and small-time chicken producers have been replaced by integrators. Malaysia is a major poultry producer in the Asia Pacific regin and the country is self-sufficient in meeting its poultry domestic demands. Malaysia currently exports live poultry (chickens) and processed poultry meat to Singapore and a few middle East countries. Poultry meat contributes a large portion to the protein needs among Malaysians largely due to the fact that beef is more expensive and most of Malaysia’s population is Muslim. Malaysia’s poultry meat consumption per capita is among the highest in the world. 2.9 million chicken eggs and 1.7 million chickens are consumed in Malaysia on a daily basis

Indonesia Poultry Industry

Indonesia is ASEAN’s largest economy and home to 255.5 million people, Indonesia is also the largest Muslim country in the world. Indonesia alone makes up nearly 50% of ASEAN’s total economic output and with a largely young and growly population that is urbanising quickly, Indonesia is one of the fastest growing consumer markets in the whole world. The demand for poultry meat in Indonesia is expected to increase rapidly driven largely to the country’s rapidly growing middle class with increasing purchasing power. Broiler meat accounts for 75% of all Indonesian poultry production and Indonesia’ per capita poultry egg and poultry meat consumption lags behind other ASEAN countries such as Malaysia and Thailand. Demand for poultry, however, is increasing fast and poultry is the main source of dietary protein in Indonesia which makes up around 86% of all meat consumption in Indonesia. Key drivers of growth in Indonesia will likely come from its population growth and urbanization.

Thailand Poultry Industry

Bordered by Cambodia, Laos, Myanmar and Malaysia, Thailand is situated on the Indochina Peninsular with a population of around 69 million people. Thailand is the world’s 32nd biggest economy and the second largest economy (after Indonesia) in ASEAN (accounting for some 17% of ASEAN’s GDP). In Thailand, the agricultural industry is the largest sector that contributes to Thailand’s employment (some 40% of all Thais work in the agricultural sector). As one of the world’s leading producter of argricultural products, Thailand’s poultry industry is the biggest in ASEAN and host both local and overseas poultry players. In 2017, Thailand’s chicken meat production is expected to increase by 5-7 percentage in 2017 due to the increase in export and over the years, Thailand’s poultry industry as moved up the value chain as one of the world’s leading poultry exporter. The avian flu outbreak in 2004 foreced the local poultry industry to adopt better poultry farmily facilities and practices – this has increase Thailand’s poultry’s production output and capacity and Thailand is widely recognised as a leader in poultry export in the world.

Around a third of Thailand’s domestic chicken meat demand comes from Thais buying fresh chicken meat from traditional Thai markets and the processed chicken meat industry for domestic demand is expected to grow in the near future. As chicken is one the most consumed meat in the world, coupled with the relatively lower prices of chicken meat, global chicken consumption is promising in the next few years.

Philippines Poultry Industry

Philippines’ population reached the 100 million mark in 2014 and this ranks the Philippines the 12th most populous country in the world. Philippines also has one of the highest population growth rate and powered by it’s growing population, consumption of meat as a source of protein is estimated to increase by 2% annually. Based on the Philippine Statistics Authority-Bureau of Statistics, demand for meat in Philippines was 1.49 million tonnes in 2014 based on an estimated 50 million Filipinos above the age of 10. The services industries makes up more than half the GDP of the Philippines and Agriculture contributes around 10% of the GDP in 2015. With an economic growth of 6.9% in 2016, Philippines is one of the fastest growing economy in Asia and grow is likely to be faster in the near term.

The Philippines is self-sufficient in domestic poultry demand and some 800 million broilers are produced annually. Despite the growing population (increased poultry demand), the country’s domestic supply continues to grow in tandem. The chicken egg and chicken broiler production industries are among the most developed food industries in the Philippines. Over the years, the poultry industry has evolved and progressed to large chicken farming operations which are integrated and enjoy considerable economies of scale. The poultry industry in the Philippines looks poised to perform any other industries and will be attracting a lot of investments in the near term. The Philippines ban any import of poultry products (deboned and processed chickens, ducks and eggs) since teh outbreak of bird flu and this ban is expected to continue to benefit the domestic poultry sector.

Vietnam Poultry Industry

Vietnam has rich natural resources such as minerals, oil and gas, fertile soil and water resources. With a GDP growth of 6.21% in 2016, Vietnam is one of the world’s fastest growing economies with an estimated 92 million people where most of the population is young. The agriculture industry in Vietnam hires the most people in terms of employment.

With a growing population, increasing income and growing middle class, the demand for poultry meat is expected to increase by 3 times by the year 2020 with the demand for eggs doubling then. This demand is created from Vietnam’s rising standard of living, rapid urbanization and economic growth. Poultry is the second most consumed meat after pork in Vietnam. For the poultry industry, production capacity is low and Vietnam is unable to meet its local domestic demand for poultry meat. As such, Vietnam imports frozen chicken meat from Hong Kong, Turkey and the United States. In Vietnam, poultry production is concentrated around the Mekong River Delta, Red River Delta and the North East areas of Vietnam.

As a poultry equipment manufacturer and supplier, we offer various poultry processing equipment to increase your poultry (chicken, turkey and duck) processing output while reducing cost at the same time.

If you are a poultry meat processing company, check out our range of chicken processing machines, duck processing machines and turkey processing machines for your poultry processing needs.

-

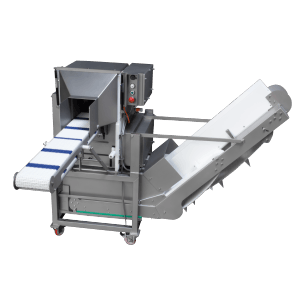

De-boning machine ST850/628DTW8

-

Steen Automatic breast skinner high out feed ST650/H machine

-

Steen AUTOMATIC BREAST SKINNER LOW OUT FEED 650 Machine

-

Steen Automatic skinner long model ST600/K machine

-

Steen Automatic Skinner Long Model ST700/K Machine

-

Steen Automatic skinner short model ST600/K10 machine

-

Steen Automatic skinner short model ST700/K10 machine

-

Steen Chicken De-boning mid-wing chicken ST820 Machine

-

Steen De-boning + cartilage remover machine low capacity ST832 machine

-

Steen De-boning machine high capacity ST800 machine

-

Steen De-boning machine low capacity ST828 machine

-

Steen Fillet splitter ST350F Machine